The MAP team Annual Report 2024 published

The Dutch State Secretary for Finance published the Team Mutual Agreement Procedures (MAP team) Annual Report 2024 on May 26, 2025. This blog sets outs the highlights of this report.

Tax certainty

Taxpayers want to have clarity and certainty about their tax position, not only in the Netherlands but also in cross-border situations. Multinationals can obtain tax certainty in:

- advance in the form of a bilateral or multilateral advance pricing arrangement (BAPA/MAPA), or

- afterwards under a Mutual Agreement Procedure (MAP) when taxpayers are confronted with double taxation.

MAP team

The responsibility for mutual agreement procedures was transferred from the Ministry of Finance to the Tax and Customs Administration/Large Enterprises Directorate/International Unit on 1 January 2022. Within the International Unit, the MAP team is responsible for mutual agreement procedures. This MAP team consults with foreign competent authorities to seek for elimination of double taxation or incorrect treaty application. In addition, the MAP team is responsible for international negotiations for bilateral or multilateral Advance Pricing Agreements (BAPAs/MAPAs) and conducting MAP procedures to determine the place of residence of companies. The MAP 2024 report describes the MAP team’s activities during 2024 (see link).

Number of procedures keeps ever increasing

The annual report includes the key figures for the year 2024. The number of BAPAs/MAPAs and MAPs requests received increased compared to the number of requests received in 2023. This continues the upward trend of recent years. The number of requests received largely depends on developments in the Netherlands and its treaty countries.

The 2024 number of requests received is 506 (2023: 386) and the number of requests completed is 449 (2023: 394); an increase of 31% and almost 14% respectively. Despite the increase in the number of requests, the Netherlands is able to resolve cases on average within the target period of 24 months. The resolution rate of MAP cases is high: above 90%.

Pre-filing meeting and arbitration

Before officially submitting a MAP request or a BAPA/MAPA request, taxpayers may request a pre-filing meeting. These pre-filing meetings may subsequently lead to an actual request for a MAP or a BAPA/MAPA (or not). A protective filing is also possible whilst pursuing objection and appeals procedures, locally.

Arbitration has not been necessary to reach a solution with treaty partners until 2024. The Netherlands is currently involved in one arbitration procedure that is expected to lead to a solution in 2025.

Other key MAP policy points

Simultaneous filing of MAPs required

One main rule under the Dutch Tax Arbitration Act is that a complaint or MAP request must be filed simultaneously with the Dutch competent authority and that of the other EU Member State involved. If this requirement is not met the complaint will be rejected. In several cases, taxpayers did not file their complaint at the same time in both EU Member States. The Netherlands takes a pragmatic approach when a complaint is not filed simultaneously in both EU Member States or simultaneously but not by all the companies involved in both EU Member States. Whether the other state involved agrees with this pragmatic approach depends on the other EU Member State involved.

Fiscal unit or subsidiary filing?

It is only when the parent company of a fiscal unit (typically a unit consisting of a parent with its wholly owned subsidiaries) is directly confronted with a transfer price adjustment or an incorrect application of the treaty that it can submit a MAP request. In other cases, it is the subsidiary of the fiscal unit that must submit the request independently. In the event of incorrect submission, the MAP request may be rejected, particularly because treaty partners abroad apply a strict interpretation on this point. In such cases, the Netherlands allows correction of default.

Withholding tax

The Netherlands applies the principle that a refund procedure for any withholding tax must first be completed. If the taxpayer has not initiated such a refund procedure, a MAP request can be rejected. Only if a refund is refused for material reasons or if no refund procedure is available, can a MAP request be validly submitted. In this context, it is important that taxpayers familiarize themselves with the requirements that apply in countries for the reclaiming of withholding taxes and also meet these requirements before submitting a MAP request.

Collection interest

Taxpayers can request a mitigation of tax or collection interest charged in the Netherlands. This possibility only applies in the context of a MAP and not for cases in which a BAPA/MAPA has been concluded.

MAP countries

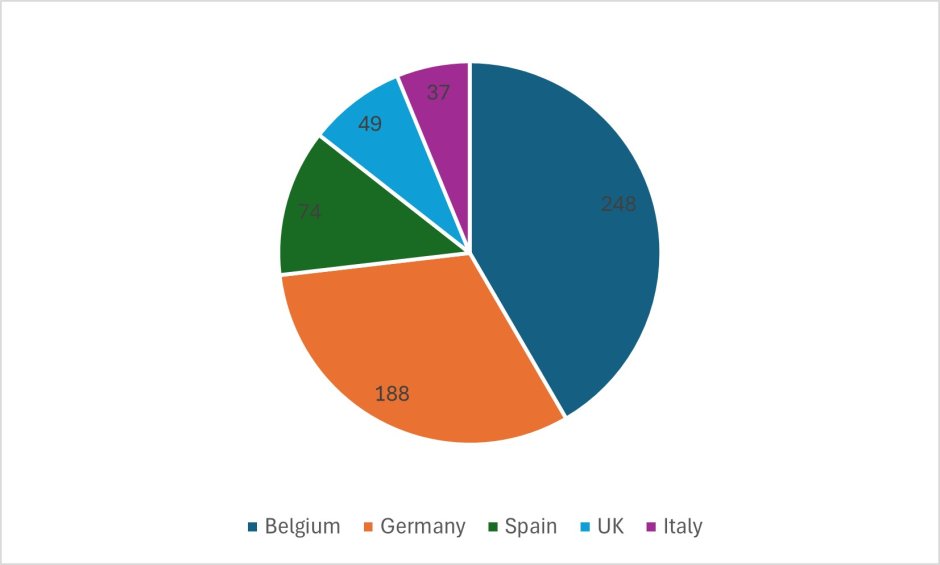

In 2024, the Netherlands had MAP cases with 58 treaty partners. For interpretation cases, this is 58 partners, for transfer pricing cases 32 partners and for corporate tiebreaker cases 10 partners. The top five countries with which the Netherlands has MAP cases in 2024 are as per below graph.

Top five

Dutch MAP awards

The Dutch MAP-team is an international leader in the handling of MAP procedures, which has also been recognized by the OECD when presenting the annual MAP awards. In both 2022 and 2023 (2024 data not yet available), the Dutch MAP team won two awards out of the five annual OECD awards (for “Most improved jurisdiction”, “Best Caseload management Large Inventories” and 2x “Best Average Time, Transfer Pricing Cases”).

Conclusion

The above demonstrates the Netherlands' commitment to providing tax certainty and adapting to the evolving tax landscape, from which taxpayers can benefit . We support these processes through our extensive experience in terms of BAPAs/MAPAs and MAPs.